TREASURY TEAMS

Save time and get more done with modern tools

Atlar is an end-to-end treasury platform that lets you manage cash, make payments, and forecast faster with real-time data

One treasury system to replace them all

Leave outdated interfaces, file transfers, and multiple logins in the past. Atlar is a next-generation platform designed to manage all critical treasury work while consolidating your banks, ERPs, and other tools. Unlike with legacy systems, you’ll be up and running in weeks, not months or years.

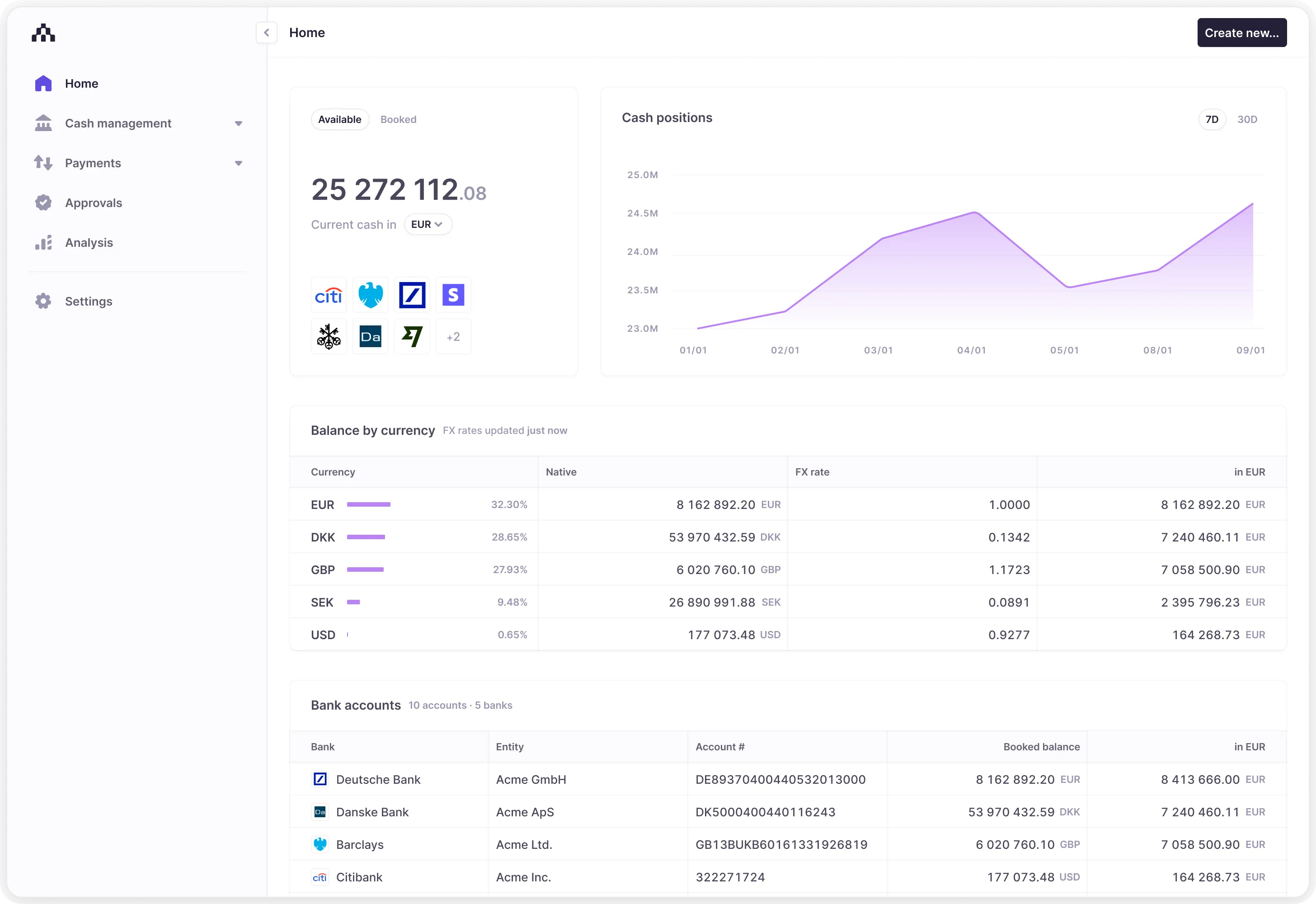

All finance data in a single view

View all cash positions and transactions in real time. Filter by market, bank, entity, balance, or currency in a user-friendly summary that lets you drill down for more details.

Powerful, easy to use analytics

Create dynamic analyses in seconds to take the hassle out of reporting and forecasting. Leverage prebuilt templates out-of-the-box, save your reports, and easily share with your team.

Connect any data source, in any format – no engineering required

Atlar connects directly to banks, payment platforms, and other finance tools and offers no-code integrations with ERPs like NetSuite and Dynamics 365.

Eliminate manual work and keep all systems in sync with a single source of truth for aggregated, standardized financial data.

Automated liquidity controls

Set up automated workflows and sweeping rules to effortlessly manage your working capital, letting you automate routine payment runs and account top-ups and drawdowns.

Secure, real-time collaboration

Ensure full compliance with internal policies like the four-eyes principle by creating custom approval workflows and role-based access controls for all payments or specific subsets.

3 reasons to choose Atlar over a Treasury Management System

Quick to implement

Quick to implement

Cut months off your implementation time

TMS software is based on two-decades old tech that requires dedicated IT support to implement, configure, and maintain over time. Atlar is a modern, cloud-based SaaS platform that lets customers get up and running in 4-6 weeks on average. Implementing a TMS can take up to 18 months, according to Deloitte's Treasury Technology Market report.

Easy to use

Easy to use

Fast, modern, and responsive platform

Teams that use a TMS daily often find the interfaces slow and unintuitive. Plus, setting up a lot of the functionality requires specialist knowledge. This leads to slower adoption rates internally and more time devoted to training. Atlar is designed with ease of use in mind – without compromising on functionality – so that advanced features like forecasting add value from day one.

Connects to modern tools

Connects to modern tools

Real-time, API-ready connectivity

TMS software connects to banks through their traditional channels, but isn’t designed to integrate with modern API-first platforms. Atlar does both and more, with built-in support for real-time payments and data. Instead of batched files and siloed systems, Atlar can receive data continuously in real time from any source – giving a complete, accurate view of your finances.

Fast moving treasury teams are making the switch to Atlar

Deciding on treasury tooling is no longer a choice between slow, heavy-duty systems and sticking to manual file transfers and spreadsheets.

Atlar is the modern, real-time platform that industry leaders like Forto, GetYourGuide, and Acne Studios trust to help them manage money.

Get started

See a demo

Discover the Atlar platform for yourself. Enter your email to get started.